XBRL (Extensible Business Reporting Language) FILING

Summary

Extensible Business Reporting Language, better known as XBRL, is used as the common (computer) language for the electronic communication of business and financial data. XBRL stands for Extensible Business Reporting Language. It is already being put to practical use in a number of countries and implementations of XBRL are growing rapidly around the world.

VGC provide XBRL services with high level of accuracy, consistency, commitment and timeliness.

The Ministry of Corporate Affairs (MCA) introduced XBRL filing of financial statements with the Registrar of Companies (ROC) through the MCA portal. Subsequently, the Companies (Filing of documents and forms in Extensible Business Reporting Language) Rules, 2017 provided that certain classes of companies must mandatorily file their financial statements and other documents under Section 137 of the Companies Act, 2013 (‘Act’) with the ROC in eform AOC-4 XBRL.

XBRL is of value to any entity for two key reasons:

- Regulatory use

- XBRL, for other uses

Applicability of XBRL Filing for Companies

- Companies listed with stock exchanges in India and their Indian subsidiaries.

- Companies having paid up capital of five crore rupees or above

- Companies having turnover of one hundred crore rupees or above

- Every company that is required to prepare its financial statements as per the Companies (Indian Accounting Standards) Rules, 2015

Following companies are exempt from filing financial statements with the ROC in XBRL taxonomy:

- Non-banking financial companies

- Housing finance companies

- Companies engaged in the insurance business and banking sector

The companies that have once filed their financial statements with the ROC in XBRL under Section 137 of the Act must continue to file their financial statements, AOC-4 and other documents in XBRL only, even when they cease to fall under the classes of companies mentioned above.

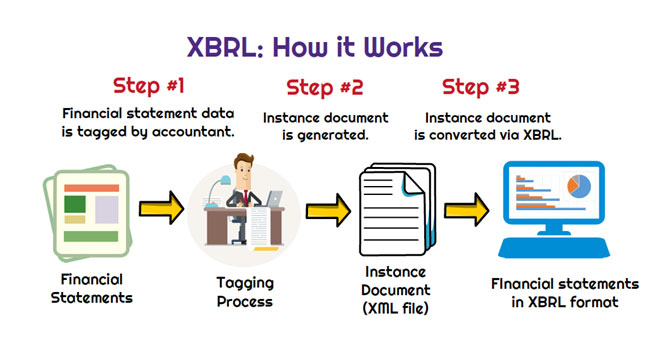

How XBRL Works

BENEFITS

Benefits of XBRL Filing

- Automation function

- Cost Reduction

- Improved Data Accuracy

- Very Reliable and Fast

- Making financial statements more useful

- Easy Data Comparison

- Time saving process

- Helps in better decision making

Penalties for failing to file XBRL financial statements

If a company fails to file its Financial Statements to ROC within prescribed time limit it will be fined of Ten Thousand Rupees (10,000) and in case of continuing failure, with a further penalty of one hundred rupees(100) for each day during which the failure continues subject to a maximum of two lakh rupees (2,00,000) For Directors Penalty of Rupees Ten Thousand (10,000) and in case of continuing failure, with a further penalty of one hundred rupees for each day after the first during which such failure continues subject to a maximum of fifty thousand rupees (50,000).

VGC provide services in relation to tagging, mapping, generation of instances documents and validation of the same at MCA XBRL Validation Tools, certification of final XBRL documents, preparation, certification and filing XBRL-e-forms.

- XBRL service in Gurgaon

- XBRL Service in Faridabad

- XBRL Service in Delhi

- XBRL Service in Noida

- XBRL Service in INDIA

Contact us today for XBRL at info@vgccs.in to learn more about our services and how we can help your business grow.